Should I Wait For Home Prices To Come Down???

Think Twice Before Waiting for Lower Home Prices

Navigating the Housing Market: Why Delaying Home Buying for a Price Crash Isn’t the Best Strategy

In the ever-evolving landscape of the housing market, it’s natural to wonder about its future direction. Among the factors that capture your attention, home prices often stand out, particularly considering their slight decline since reaching their peak last June. You might have come across news articles or social media posts predicting an impending price crash. Consequently, you might be contemplating postponing your home purchase until prices plummet substantially. However, it’s essential to understand why adopting this strategy may not be the most prudent approach.

- Market Dynamics:

While home prices experienced a dip after reaching their peak, it’s important to remember that the housing market is dynamic and subject to various factors. Instead of solely relying on short-term fluctuations, it is more valuable to assess the broader market trends, historical patterns, and economic indicators. Taking a comprehensive view will provide you with a clearer understanding of the housing market’s stability and the potential for price adjustments.

- Affordability and Interest Rates:

Delaying your home purchase based on an expectation of a significant price drop comes with its own set of risks. In the interim, interest rates could rise, making mortgage financing more expensive. Additionally, while prices might decrease marginally, the overall affordability of homes could diminish due to increased demand or inflationary pressures. Waiting indefinitely for a price crash might lead to a situation where you end up paying more for the same property when factoring in higher interest rates or reduced affordability.

- Emotional and Lifestyle Considerations:

Beyond financial aspects, it’s important to consider the emotional and lifestyle factors associated with homeownership. Waiting for an extended period in hopes of a price crash might delay your plans to settle into your dream home and establish roots in a community. Moreover, if you’re currently renting, the cost of renting can accumulate over time, potentially offsetting any potential savings from waiting for a price drop.

- Long-Term Investment Perspective:

Real estate has historically shown resilience and long-term appreciation. While short-term fluctuations are possible, over the years, property values tend to rise. By focusing on the long-term investment potential of homeownership, you can take advantage of the opportunity to build equity and enjoy the benefits of owning a home. Rather than solely fixating on timing the market, consider the potential gains you can secure by entering the housing market when it aligns with your personal and financial goals.

While it’s natural to be concerned about home prices and the possibility of a price crash, delaying your home purchase solely based on this expectation may not be the best strategy. Instead, take a holistic approach by considering market dynamics, affordability, interest rates, emotional and lifestyle factors, and the long-term investment perspective. Engage in thorough research, consult with real estate professionals, and align your decision with your personal circumstances and goals. At the end of the day, finding a home that meets your needs and aligns with your financial capabilities is the key to a successful homeownership journey.

A recent survey from Zonda shows 53% of millennials are still renting right now because they’re waiting for home prices to come down. But here’s the thing: the most recent data shows that home prices appear to have bottomed out and are now on the rise again. Selma Hepp, Chief Economist at CoreLogic, reports:

“U.S. home prices rose by 0.8% in February . . . indicating that prices in most markets have already bottomed out.”

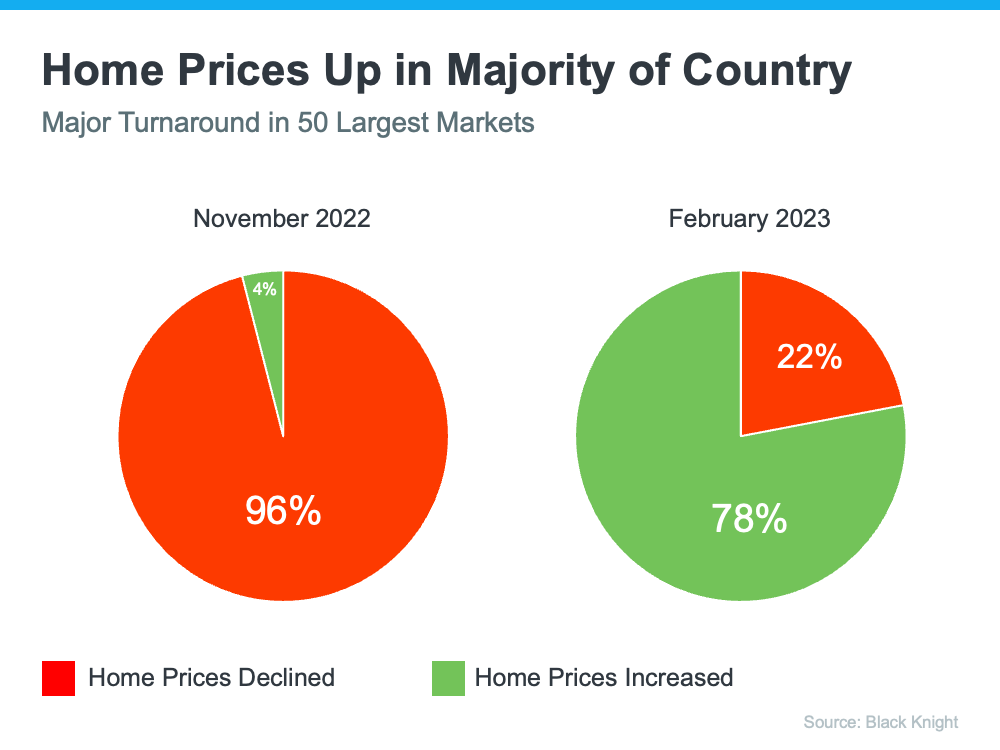

And the latest data from Black Knight shows the same shift. The graph below compares home price trends in November to those in February:

So, should you keep waiting to buy a home until prices come down? If you factor in what the experts are saying, you probably shouldn’t. The data shows prices are increasing in much of the country, not decreasing. And the latest data from the Home Price Expectation Survey indicates that experts project home prices will rise steadily and return to more normal levels of appreciation after 2023. The best way to understand what home values are doing in your area is to work with a local real estate professional who can give you the latest insights and expert advice.

Bottom Line

If you’re waiting to buy a home until prices come down, you may want to reconsider. Let’s connect to make sure you understand what’s happening in our local housing market.

www.APPLYWITHREGION.com